Powering Your Payments

All-in-One Merchant Services That Work for You

From in-store to online, our payment solutions are built to streamline transactions, safeguard data, and fuel your business growth.

What We Offer

We go beyond processing. Our platform supports real-time reporting, fraud prevention, EMV compliance, and easy integration with your existing systems—so you can focus on what matters most: running your business.

Advanced fraud protection

Full reporting dashboard

EMV and PCI-compliant tech

Modern Solutions for Today’s Businesses

Next Stage Payments provides secure, scalable credit card processing tools designed to fit your workflow. Whether you need mobile processing, countertop terminals, or seamless e-commerce integration, we’ve got you covered.

Fast, secure payment processing

Flexible for any business type

Designed to scale as you grow

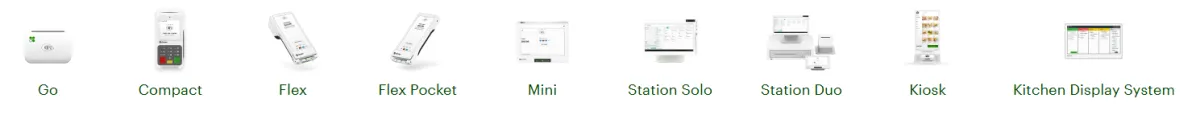

Explore Additional Clover Equipment Options

Equip your business with the right Clover tools—from countertop systems to mobile solutions—to streamline operations and accept payments anywhere.

Enhanced Risk Merchant Services

For a number of reasons, some merchants are fairly or unfairly categorized as high risk, enhanced risk or unqualified by some payment processing companies. Either the nature of your product or service is deemed risky due to return rates, risk of chargebacks or your business is viewed as unstable from an insufficient funds perspective. Perhaps your particular industry has a high rate of failure that creates risks concerning pre and post sales/service fulfillment. Some industries have stricter regulations (or few regulations). All these factors and more can brand the business with an unsavory reputation that make many banks avoid them. Next Stage Payments is able and willing to help these businesses navigate this challenging and often frustrating process.

Subscription & Membership Services

Recurring billing models for memberships and access-based services.

Hemp Services

CBD and hemp product retailers or manufacturers.

Multi-Level Marketing

Commission-based network sales businesses.

Money Service Businesses

Check cashing, money transfer, and similar financial services.

Travel Agents

Online and offline travel and vacation booking services.

Bail Bonds

Legal and financial bail bonding services.

Pawn Shops

Collateral-based lending and resale operations.

Foreign-Based Businesses

International businesses operating or serving U.S. customers.

Nutraceuticals & Supplements

Dietary, wellness, and herbal product sellers.

Firearms & Ammo

Retailers of guns, ammunition, or accessories.

Debt Collection Services

Third-party collections and recovery firms.

Vape & Glass Paraphernalia

Smoke shops and vape product sellers.

Kratom

Vendors of kratom-based herbal products.

Seed

Retailers or breeders of unconventional seeds.

Unconventional

Nontraditional or emerging industries considered high-risk.

These types of businesses may face incredible hurdles when they require payment processing services. Next Stage Payments is your preferred provider if you operate a small to medium-sized high risk business.

We are proud to work with the following affiliates

Ready to Take the Next Step?

Schedule Your Free

Consultation Today

Let’s talk about your payment needs and build a custom solution that works for your business—no obligation, just real support.

Frequently Asked Questions

You’ve Got Questions—We’ve Got Answers

Question 1: How long does it take to get set up?

Most businesses are fully onboarded and ready to process payments within 48–72 hours, depending on the complexity of your setup.

Question 2: Are there any hidden fees?

No. Our pricing is fully transparent, and you'll always know what you’re paying for upfront—no surprises.

Question 3: Can I use my existing hardware?

In many cases, yes. We’ll evaluate compatibility and either integrate your current system or offer the best-fit replacement at a competitive rate.

Question 4: What kind of businesses do you work with?

We support a wide range—from local shops and service providers to national e-commerce brands. We customize solutions based on your needs.

Fast, Efficient Setup & Seamless Integration

We make onboarding easy. Our team works closely with you to ensure a smooth, stress-free setup. From choosing the right hardware to syncing your e-commerce tools, we’ve got your back.

3-step easy onboarding

Support with every setup

Ready-to-use in under 72 hours

TESTIMONIALS

What others are saying

Top-Notch Service

"The personal support has been a game changer for us!"

- Jessica Lane

Fast & Reliable

"Setup was quick, and everything worked flawlessly."

- Michael Reyes

Great Experience

"Finally, a payment partner that actually cares."

- Emily Chen

Let’s Talk About Your Payment Needs

Schedule a quick consultation and discover a better way to process payments—tailored just for your business.

FOLLOW US

Copyright 2026. Next Stage Payments. All Rights Reserved.